Renseignements pour les chauffeurs de Californie

Cette page donne des renseignements sur les exigences relatives au véhicule et à la documentation à remettre, la réglementation étatique, la couverture d'assurance et les exigences particulières à chaque ville, nécessaires à la conduite avec Lyft dans l'État de la Californie.

Pour pouvoir conduire en Californie, soumettez votre candidature en ligne ou dans l’appli Chauffeur Lyft – vous pouvez la télécharger sur l’App Store (iOS) ou sur le Google Play Store.

Les chauffeurs de Californie peuvent être admissibles à une subvention aux soins de santé. Les chauffeurs de Californie n'ont pas besoin d'accepter de demande spécifique de services pour maintenir l'accès à l'appli Lyft ou à la plateforme Lyft.

Passer à :

Ce qu’il faut pour conduire avec Lyft en Californie

Les chauffeurs doivent maintenir leurs documents à jour. Omettre de mettre à jour un document requis avant la date d'expiration provoquera une désactivation temporaire.

Utilisez l'appli Chauffeur Lyft ou le Tableau de bord du chauffeur pour téléverser vos documents. Pour ajouter des documents dans l'application, appuyez sur « Compte » dans le menu principal, puis sur « Documents ».

Exigences relatives au véhicule

Tous les véhicules doivent répondre aux critères suivants :

- 2008 ou plus récent

- 4 portes

- 5 à 8 sièges, y compris le siège du chauffeur

- Pas un taxi, une limousine extensible ou un véhicule de location autre que Conduite Express

- Non désigné comme étant envoyé à la récupération, irréparable, restauré ou toute autre classification équivalente.

- Plaque d’immatriculation de la Californie*

*Les chauffeurs peuvent téléverser une plaque d’immatriculation temporaire en attendant leur numéro de plaque permanent. Une fois que vous avez ajouté un véhicule à votre profil, vous avez 60 jours pour téléverser un numéro de plaque d’immatriculation permanent.

Les candidats militaires en service actif et les personnes à leur charge peuvent avoir une plaque d'immatriculation d'un autre État.

Voyez si votre véhicule est admissible aux types de course haut de gamme pour gagner plus sur chaque course.

Dans certaines villes, vous pouvez louer une voiture par l'intermédiaire de Conduite Express avec une assurance standard incluse. Les véhicules de location doivent être loués par l'entremise du programme Conduite Express pour être autorisés sur la plateforme Lyft. Voyez-en plus sur Conduite Express.

Exigences relatives aux chauffeurs

- Permis de conduire valide de la Californie

- Les permis temporaires de la Californie sont acceptables

- Les candidats en service militaire actif et les personnes à leur charge peuvent détenir un permis de conduire et des documents de véhicule provenant de l’extérieur de l’État ou de la province. Sélectionnez « Contacter l’assistance » ci-dessous pour vérifier votre statut de service militaire actif ou celui de votre partenaire.

- 25 ans ou plus

- Passez un contrôle de conduite, qui passe en revue vos antécédents de conduite et vos antécédents criminels. Voyez-en plus sur les contrôles des chauffeurs.

- Avoir un téléphone intelligent qui peut télécharger et exécuter l'appli Chauffeur Lyft. En savoir plus sur les recommandations de logiciels de téléphonie.

Documents requis

- Photo du profil du chauffeur : Apprendre à prendre la meilleure photo

- Assurance véhicule personnelle émise en Californie, avec votre nom sur la police

Inspection des véhicules en Californie

Les chauffeurs sont tenus de faire inspecter leur véhicule par un mécanicien agréé avant d'être autorisés à conduire. Une fois terminé, téléchargez votre formulaire d'inspection dans votre appli Chauffeur Lyft ou votre Tableau de bord du chauffeur.

Vous pouvez facilement trouver un lieu d'inspection dans votre appli Chauffeur. N'oubliez pas d'apporter une copie de ce formulaire à votre rendez-vous.

Vous pouvez également effectuer votre inspection dans un emplacement tiers. Les inspections coûtent généralement entre 20 et 30 $ , selon l'emplacement. Lyft ne couvre pas le coût des inspections effectuées dans des emplacements tiers.

Les inspections doivent être effectuées tous les 12 mois ou tous les 50 000 milles, selon la première éventualité. L'exigence de 50 000 milles inclut les milles parcourus lorsque vous n'êtes pas connecté à la plateforme Lyft. Si vous parcourez plus de 50 000 milles avant la date de votre renouvellement annuel, vous devrez passer une nouvelle inspection.

Inspection des véhicules à Los Angeles, San Diego, San Francisco, San Jose et San Mateo

Les chauffeurs sont tenus de faire inspecter leur véhicule avant d'être autorisés à conduire. Cette inspection doit être effectuée par un mécanicien agréé :

- Vous pouvez trouver un lieu pour votre inspection et fixer un rendez-vous dans votre application Chauffeur Lyft.

- Imprimez ce formulaire et apportez-le à votre rendez-vous.

- Une fois rempli, téléversez votre formulaire d'inspection dans votre appli Chauffeur Lyft.

Pour téléverser votre formulaire d'inspection :

- Ouvrez le menu dans votre appli Chauffeur Lyft.

- Touchez « Compte ».

- Touchez « Documents ».

Lyft ne couvre pas le coût des inspections.

Les inspections doivent être effectuées tous les 12 mois ou tous les 50 000 milles, selon la première éventualité. L'exigence de 50 000 milles inclut les milles parcourus lorsque vous n'êtes pas connecté à la plateforme Lyft. Si vous parcourez plus de 50 000 milles avant la date de votre renouvellement annuel, vous devez passer une nouvelle inspection.

Permis d’exploitation de commerce

Si vous avez conduit avec Lyft pendant plus de 30 jours au cours de la dernière année fiscale, la ville ou le comté où vous vivez peut vous demander d'obtenir un permis d'exploitation de commerce.

Gardez votre permis d'exploitation de commerce dans votre véhicule au cas où les autorités demandent à le voir.

Si la ville ou le comté où vous vivez n'exige pas de permis d'exploitation de commerce, vous n'avez pas besoin d'obtenir un permis d'exploitation de commerce ailleurs pour conduire avec Lyft, mais il peut y avoir des exigences supplémentaires. Consultez le site Web de votre ville ou du comté (county) pour connaître les exigences.

Sélectionnez votre ville pour en savoir davantage :

Fresno

Les résidents de Fresno peuvent obtenir un Certificat de taxe professionnelle en faisant une demande en ligne ici.

Grover Beach

Les résidents de Grover Beach peuvent obtenir un Certificat de taxe professionnelle en visitant le service du développement communautaire. Il est possible de trouver les instructions de candidature ici.

Los Angeles

Les résidents de Los Angeles County devront peut-être enregistrer leur commerce auprès du Office of Finance of the City of Los Angeles afin d'obtenir et de détenir un certificat d'enregistrement fiscal (Tax Registration Certificate). Consultez les règles de l'enregistrement.

Si vous ne savez pas si la règle en matière d'impôts s'applique à vous, communiquez avec le City of Los Angeles Office of Finance.

Orange County

Les résidents d'Orange County peuvent trouver des informations sur les exigences relatives au permis d'exploitation de commerce en sélectionnant leur ville sur la page des permis d'Orange County.

Sacramento County

Les résidents de villes non incorporées du Sacramento County peuvent obtenir un permis d'exploitation de commerce général sur la page officielle du Sacramento County.

San Diego

Les résidents des villes incorporées au San Diego County sont tenus d'obtenir un permis d'exploitation de commerce (Business Tax Certificate).

Les permis d'exploitation de commerce ne sont pas requis pour les résidents de villes non incorporées dans le San Diego County. Pour demander ce permis (Business Tax Certificate), suivez ces instructions du San Diego County.

San Francisco

Les résidents de San Francisco ayant conduit plus de 30 jours au cours du dernier exercice financier sont tenus d'avoir un permis d'exploitation de commerce, officiellement nommé « Business Registration Certificate ».

Consultez cette page pour vous inscrire en tant qu'entreprise à San Francisco. Sélectionnez « Continuer » pour commencer le processus de candidature.

On vous demandera de fournir les renseignements suivants :

- Votre entreprise :La plupart des chauffeurs choisissent l'entreprise individuelle comme type d'organisation et utilisent leur nom légal comme nom commercial. Vous devrez également ajouter votre numéro fiscal d'identification d'entreprise et votre date de début d'activité à San Francisco.

- Informations sur la propriété : On vous invitera à saisir vos informations personnelles

- Coordonnées : Vos coordonnées peuvent être identiques à celles de votre propriété à l'étape 2. Toutes les informations fiscales seront envoyées à la personne et à l'adresse que vous saisissez ici.

- Information sur le lieu :

- Nom commercial de l'emplacement : La plupart des chauffeurs utilisent le nom de l'entreprise mentionné à l'étape 2, mais il peut s'agir d'un autre nom utilisé pour votre entreprise.

- Date de début à SF : La date à laquelle l'activité commerciale a commencé à cet emplacement de San Francisco.

- Taxe et frais : La plupart des chauffeurs sélectionnent « Non » pour chaque taxe et frais. Consultez cette page pour vérifier les taxes et les frais qui s'appliquent à vous.

- Activités commerciales : La plupart des chauffeurs s’inscrivent en tant que chauffeur pour une Société de réseau de transport ou TNC (17B). Voir plus d’informations sur les codes d’activités commerciales.

- Inscription :

- Charges de personnel SF estimées : Constituent le montant approximatif des coûts relatifs au personnel à San Francisco que vous prévoyez pour l'exercice financier en cours.

- Recettes brutes estimées de SF : Ne doivent pas absolument représenter un montant exact. Si vous conduisez dans plusieurs comtés, faites de votre mieux pour estimer les tarifs de San Francisco en fonction de la fréquence de vos courses dans cette ville. Cliquez ici pour en savoir plus sur les recettes brutes.

Une fois que vous aurez saisi ces informations, vous recevrez un courriel pour compléter la procédure de demande de permis d'exploitation de commerce.

Remarques importantes :

- Avis : une fois que vous obtenez un « Business Registration Certificate », la ville ajoutera le nom de l'entreprise, l'adresse et d'autres renseignements sur le site Web SF OpenData. Par conséquent, à l'exception de votre NAS, toutes les données que vous partagerez, y compris votre adresse, seront publiques. Ces renseignements peuvent également être partagés avec la ville de San Francisco et les entités de perception des impôts des comtés (county).

- Après l'enregistrement, la Ville pourrait estimer que vous devez des frais supplémentaires et de retard pour avoir conduit lors des années précédentes. Ne payez pas de frais d'enregistrement jusqu'à ce que vous receviez un courriel précis du Treasurer and Tax Collector supprimant les pénalités et les intérêts du solde de votre compte.

Gardez à l'esprit que l'information mentionnée ci-dessus ne constitue pas un conseil commercial ou fiscal. Si vous avez des questions précises concernant la demande d'un permis d'exploitation de commerce ou les frais connexes, consultez les directives de San Francisco relatives à l'enregistrement d'une nouvelle entreprise ou contactez le Office of the Treasurer & Tax Collector.

Santa Barbara

Les résidents de Santa Barbara peuvent obtenir un Certificat de taxe professionnelle en faisant une demande en ligne ici.

San José

Les résidents de San Jose peuvent obtenir un permis d’exploitation de commerce en soumettant un formulaire de candidature par la poste ou en personne.

- Adresse en cas d'envoi postal :

- City of San Jose – Finance Department, Attention: Payment Processing

- Adresse si vous effectuez la livraison en personne :

- Ville de San José, fenêtre 1 ou 2 du Service à la clientèle

Exigences relatives aux vignettes et aux permis

Vignette Lyft

La vignette Lyft est la présentation commerciale officielle de Lyft. Cela permet aux passagers et aux agents de police d'identifier votre véhicule.

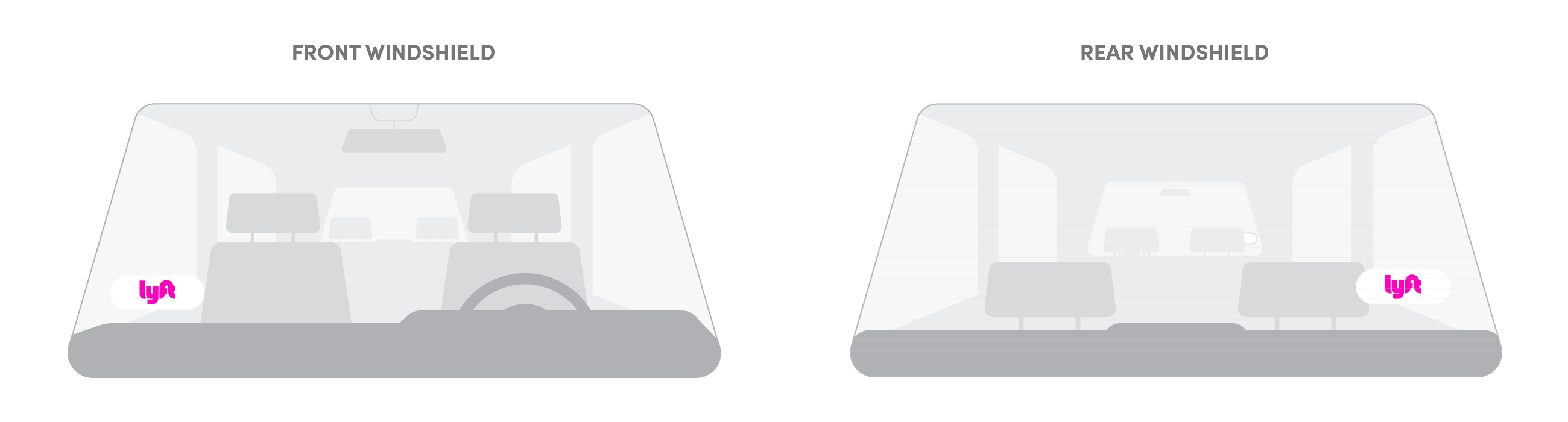

La Commission des Services Publics de la Californie (CPUC) exige que les chauffeurs en Californie affichent en tout temps deux vignettes Lyft lorsqu'ils sont en mode Chauffeur — une sur le pare-brise avant l'autre sur le pare-brise arrière.

Si vous venez tout juste de recevoir votre approbation pour conduire, vous devriez recevoir votre vignette Lyft d'ici une à deux semaines. Si vous n'en avez pas eu ou si vous en avez besoin d'un nouveau, commandez-en un dans votre appli Chauffeur Lyft ou votre Tableau de bord du chauffeur. En attendant que votre vignette arrive, vous pouvez imprimer une vignette temporaire.

La vignette Lyft doit être installée au coin inférieur des pare-brises (côté passager) chaque fois que vous passez en mode Chauffeur. Assurez-vous de retirer votre vignette lorsque vous n'êtes pas en mode Chauffeur.

Permis d'aéroport

Lorsque vous effectuez des courses aux aéroports OAK, LAX ou SFO, vous devez afficher un permis d'aéroport supplémentaire dans votre pare-brise avant.

Réglementation pour les chauffeurs de Californie

Veillez à respecter ces règles lorsque vous effectuez des courses en Californie, et restez à l'affût des mises à jour importantes de Lyft dans vos courriels.

Limites horaires du mode Chauffeur

En plus des pauses et des limites de temps obligatoires imposées par Lyft, les chauffeurs californiens ne peuvent pas :

- Effectuer des courses pendant plus de 10 heures au total dans une fenêtre de 15 heures sans prendre une pause d'au moins 8 heures.

- Effectuer des courses pendant plus de 10 heures au total dans une fenêtre de 15 heures sans prendre une pause d'au moins 8 heures.

Meilleures pratiques

- Affichez l'ensemble des vignettes et permis d'aéroports exigés

- Ayez toujours votre permis de conduire et vos documents d'assurance.

- Respectez toutes les règles d’aéroports.

- N'acceptez pas les courses sollicitées spontanément sur la rue.

- N'acceptez pas d'argent comptant pour vos courses.

- N'attendez pas dans les voies destinées aux taxis.

Connaître son assurance

À compter du 1er juillet 2015, la Californie a adopté le projet de loi AB 2293. En vertu de cette loi, les entreprises de réseau de transport (Transportation Network Companies), dont Lyft, sont tenues de proposer une assurance responsabilité civile et de maintenir une couverture complémentaire de 200 000 $ pendant la période 1.

L’assurance responsabilité civile automobile de Lyft sera votre couverture de première ligne pendant la période 1. Lyft maintiendra également une couverture de responsabilité excédentaire de 200 000 $ au cours de la période 1.

Période 1

La période 1 commence au moment où vous vous connectez en mode Chauffeur et se termine lorsque vous acceptez une commande de course.

Une fois que vous acceptez une course, la période 2 commence. Une fois que vous avez embarqué un passager, la période 3 commence. La période 3 se termine aussitôt que vous terminez la course. Ensuite, vous êtes de retour en période 1 jusqu'à ce que vous acceptiez une autre commande de course ou que vous soyez déconnecté du mode Chauffeur.

En vertu de AB 2293, votre police d’assurance automobile personnelle, y compris les couvertures facultatives achetées comme la couverture complète et en cas d'accident, ne couvre pas la conduite en covoiturage en Californie, sauf si vous avez aussi acheté aussi une couverture de covoiturage.

Certains assureurs offrent des produits d'assurance conçus spécialement pour les chauffeurs qui font du covoiturage. Ces polices peuvent couvrir à la fois votre conduite personnelle et la conduite de covoiturage et offrent des garanties supplémentaires.

Nous essayons d'informer les chauffeurs au fur et à mesure que de nouveaux produits d'assurance deviennent disponibles pour les chauffeurs en covoiturage. Communiquez avec votre compagnie d’assurance, votre agent ou votre courtier pour en savoir plus. Pour en savoir plus , cliquez ici.

- Affichez les Certificats d'assurance-responsabilité de la Californie

Déménagement vers ou depuis la Californie

Si vous êtes déjà chauffeur dans un autre État et que vous déménagez en Californie, envoyez-nous un message contenant les renseignements suivants :

- La date de votre déménagement

- Votre nouvelle adresse d'expédition

- Des photos claires des éléments suivants :

- Permis de conduire de la Californie

- Une plaque d'immatriculation de la Californie pour votre véhicule

- Assurance véhicule personnelle émise en Californie, avec votre nom sur la police

- Certificat d'inspection du véhicule de la Californie émis par un établissement agréé

Si vous avez déjà versé à votre dossier Lyft les documents de la Californie listés ci-dessus, vous n'avez pas à nous le faire parvenir de nouveau.

Les candidats en service militaire actif et les personnes à leur charge peuvent détenir un permis de conduire et des documents de véhicule provenant de l’extérieur de l’État ou de la province. Sélectionnez « Contacter l’assistance » ci-dessous pour vérifier votre statut de service militaire actif ou celui de votre partenaire.

Vous déménagez de la Californie vers un autre État? Sélectionnez votre nouvel emplacement ici pour voir les démarches à effectuer.