British Columbia Insurance Policy

The subject of insurance can be a complicated one, but it’s important you know how and when our policies cover you and your passengers in the event of an incident. The following is an overview of how our insurance policies work. Below are the three coverages included in our insurance policies (policy limits vary based on the period of a ride):

- Basic Insurance Coverage

- Enhanced Care Coverage

- Collision and Comprehensive Coverage

Skip to:

How to report an accident

Please report any accidents to our Trust & Safety team using our call feature here.

What coverages does Lyft provide?

Basic Insurance Coverage

Our liability coverage is designed to act as the primary coverage during the time the ride has been accepted and the driver is en-route to pick up a passenger until the ride has ended in the app . The policy provides coverage for bodily injuries or losses others may suffer in the event of an accident.

Enhanced Care Coverage

This provides care and recovery that you are entitled to receive if you are injured in an accident, regardless of who caused the accident. The details of the Enhanced Care Coverage are set out in the ICBC Enhanced Care Overview. This is available during the time the ride has been accepted and the driver is en-route to pick up a passenger until the ride has ended in the app.

Collision and Comprehensive Coverage

This provides coverage for repairs to your vehicle, as well as related expenses in the event of an accident when a third party is responsible for the accident. The coverage will apply up to the actual cash value of your vehicle or cost of repair, whichever is less, subject to a $2,500 deductible. This is available during the time the ride has been accepted and the driver is en-route to pick up a passenger until the ride has ended in the app.

Note: All coverages may be modified to comply with local regulations and/or provincial laws.

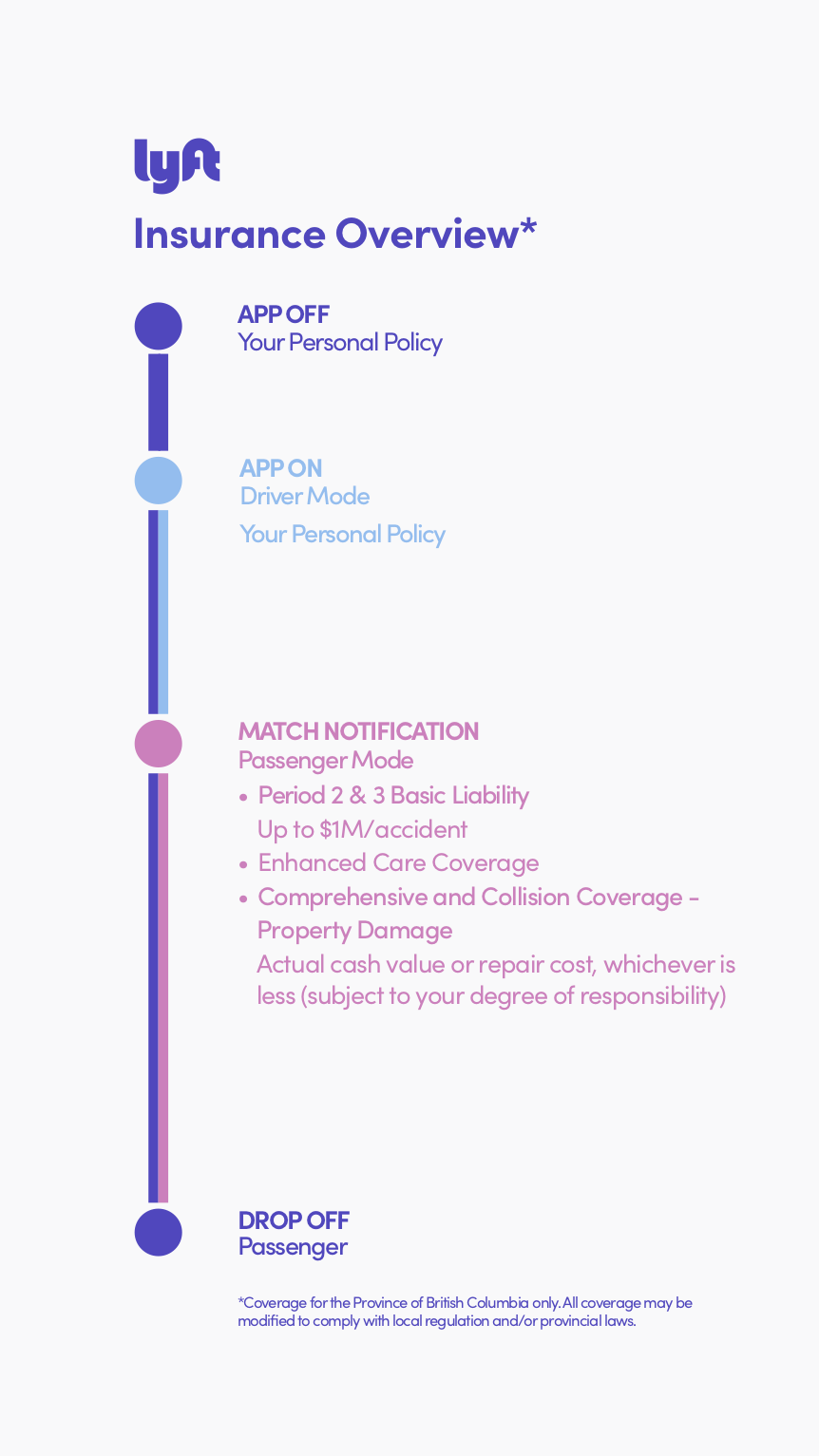

When do these coverages apply?

Personal use: Coverage when driver mode is off

Your personal auto insurance is your insurance policy.

Pre-Acceptance: Driver mode is on but no ride accepted

Your personal auto insurance is your insurance policy.

Post-Acceptance: Ride request accepted through the end of Lyft ride

The following coverages apply in this period:

- Basic insurance: $1,000,000 per accident

- Enhanced Care coverage

- Collision and Comprehensive coverage: Actual cash value or cost of repair, whichever is less ($2,500 deductible)

Note: All coverages may be modified to comply with local regulations and/or provincial laws.

What provinces and territories of Canada are covered by this policy

Currently, our policy is only available in British Columbia. Go to Lyft's Certificates of Insurance & Auto Policies to download a copy of our Certificate of Liability Insurance or Auto Liability Policy.

Lyft works with ICBC, to assist with auto insurance claims.

See also: