加州司机信息

本页提供在加利福尼亚州与Lyft驾驶所需的车辆、司机和文件要求、州法规、保险覆盖范围及城市特定要求的相关信息。

要申请成为加利福尼亚州司机,请在线或在 Lyft 司机端 app 提交申请表,该 app 可从 App Store (iOS) 或 Google Play 商店下载。

加州的司机可能有资格获得医疗补助。 加州的司机无需接受任何特定的服务叫车,以维持对Lyft app或Lyft平台的访问权限。

跳至:

成为 Lyft 加利福尼亚州司机的要求

司机必须维持文件有效性。如果在到期日期前未能更新必要文件,则会导致账户暂时停用。

使用 Lyft 司机端 App 上传您的文件。要在 App 中添加文件,请在主菜单中轻触“账户”,然后选择“文件”。

车辆要求

所有车辆必须满足以下条件:

- 2013 年或更新

- 4个车门

- 5-8 个座位(包括司机驾驶座)

- 非出租车、加长豪华轿车或非伙伴租车计划 (Express Drive) 的租赁车辆

- 未被标记为报废、不可修复、经修复或其他任何等效分类

- 加州车牌*

*司机可以在等待正式车牌号码时上传临时车牌。一旦您将车辆添加到您的个人资料中,您有60天的时间上传正式车牌号码。

现役军人申请者及其家属可以拥有外州车牌。

查看您的车辆是否符合高级行程类型的资格,以便在每次行程中赚取更多收入。

在特定城市中,您可以通过 伙伴租车计划 (Express Drive) 租赁汽车,且包含标准保险。租赁车辆必须通过伙伴租车计划 (Express Drive) 租赁,才能被批准在Lyft平台上使用。 了解更多关于伙伴租车计划 (Express Drive)。

司机要求

- 有效的加州司机执照

- 加州临时驾照是可以接受的

- 现役军人申请者及其家属可以持有州外的驾照和车辆文件。选择下方的“联系支持”以验证您或您配偶的现役军人身份。

- 25岁或以上

- 完成司机筛查,其中包括驾驶历史检查和刑事背景调查。了解更多关于司机筛查的信息。

- 请注意,根据加利福尼亚法律,包括加利福尼亚公共事业法典第5445.2条和加利福尼亚商业与职业法典第7458条,Lyft必须取消有某些犯罪历史的申请人在Lyft平台上驾驶的资格。

- 拥有可以下载并运行Lyft 司机端 app的智能手机。 了解更多关于手机软件推荐的信息。

文档要求

- 司机头像: 了解如何拍出最佳照片

- 在加利福尼亚州签发的个人车辆保险,保单上列出您的姓名

加州车辆检查

司机需要由持牌机械师完成车辆检查后,才能获得驾驶资格。完成后,请将检查表上传到你的Lyft 司机端 app或仪表板。

您可以在司机端 app 中轻松找到检查地点。别忘了带上此表格副本进行预约的检查。

您也可以在第三方地点完成检查。检查的费用通常在 $20-$30 之间,具体取决于设施。Lyft 不承担第三方地点检查的费用。

检查必须每12个月或50,000英里完成,以先到者为准。50,000英里的要求包括未登录Lyft平台时驾驶的里程。如果在年续日期前行驶超过50,000英里,您必须进行新的检查。

洛杉矶、圣地亚哥、旧金山、圣何塞和圣马特奥车辆检查

驾驶员必须通过车辆检查才能获得驾驶许可。此检查必须由具备资质的机械师完成:

- 您可以在 Lyft 司机端 app 中找到检验地点并安排预约。

- 打印这份表格并带到您的预约。

- 完成后,将您的检查表上传到您的 Lyft 司机端 app。

上传您的检查表:

- 在你的Lyft 司机端 app中打开菜单。

- 点击“账户”。

- 轻触 'Documents.'

Lyft 不承担检查的费用。

检查必须每12个月或5万英里完成一次,以先到者为准。5万英里的要求包括未登录Lyft平台时的行驶里程。如果在年度更新日期之前行驶超过5万英里,则必须进行新的检查。

营业执照

如果您在上个财政年度内为Lyft开车超过30天,您所在的城市或县可能会要求您办理营业执照。

请随车携带您的营业执照,以防当局要求检查。

如果您所在的城市或县不要求营业执照,您无需在其他地方获取营业执照来驾驶Lyft,但可能会有额外的规定。请查阅您当地城市或县的网站以了解这些规定。

请选择您的城市以查看详细信息:

弗雷斯诺

弗雷斯诺居民可以在此在线申请以申领营业税登记证。

Grover Beach

格罗弗海滩居民可以访问社区发展部门以申领营业税登记证。您可以在此找到申请操作说明。

洛杉矶

洛杉矶县居民可能需要向洛杉矶市金融办公室注册其公司,并获得和持有税务登记证。查看注册规则。

如果您不确定营业税规则是否适用于您,请联系洛杉矶市金融办公室。

请访问公平机会条例通知

橙县

橙县居民可通过在橙县许可证页面上选择他们的城市,找到关于当地营业执照要求的信息。

萨克拉门托县

萨克拉门托县非建制地区的居民可以在萨克拉门托县的官网上获取营业执照。

圣迭戈

圣迭戈县辖区内的城市居民需要获得营业执照(营业税证书)。

圣迭戈县内非建制城市的居民无需营业执照。要申请营业税证书,请按照圣迭戈县的这些说明。

旧金山

在上个财政年度驾驶超过30天的旧金山居民需要取得营业执照,官方名称为Business Registration Certificate。

访问此页面以在旧金山注册为企业。 选择‘继续’以开始您的申请表。

您将被要求提供以下信息:

- 您的业务: 大多数司机选择个体经营作为组织类型,并使用其法定姓名作为业务名称。您还需要添加您的营业税身份证件以及业务在旧金山的开始日期。

- 所有权信息: 您将被要求填写您的个人信息

- 联系信息:您的联系信息可能与步骤 2 中的所有权信息相同。所有税费信息都会发送至在此处填写的人员和地址。

- 位置信息:

- 地点商号: 大多数司机使用第2步中的公司名称,但这可以是您业务使用的任何其他名称

- 在旧金山的开始日期: 业务活动在这个旧金山地点开始的日期

- 税费和手续费: 大多数司机在每个税费和手续费项上选择“不”。 请查看此页面以确认哪些税费和手续费适用于您。

- 商业活动: 大多数司机注册为运输网络公司司机(17B)。 查看更多关于商业活动代码的信息。

- 注册:

- 预计旧金山工资费用: 你在当前日历年预计的旧金山工资成本的大致金额

- 预估旧金山总收入: 不需要是准确的金额。如果您在多个县驾驶,请尽量根据您在旧金山市区的频率预估车费。查看更多关于总收入的信息。

一旦您输入了这些信息,您将收到一封电子邮件以完成营业执照申请表的流程。

重要提示:

- 您一旦注册了商业注册证书,市政府会将企业名称、地址和其他一些详情添加到 SF OpenData 网站。这意味着除了您的 SSN 以外,您分享的任何数据,包括您的地址,都会公开。这些信息也可能会与旧金山市和县的税费征收部门共享。

- 注册后,市政府可能会通知你,你欠以前年度驾驶的额外手续费和滞纳金。在收到市财政司和税务官发来的删除账户余额中罚款和利息的具体电子邮件之前,不要支付行车执照手续费。

请记住,以上信息不是商业或税务建议。如需了解有关申请营业执照或相关费用的具体问题,请查看旧金山新业务注册指南或联系财务与税务办公室。

圣巴巴拉

Santa Barbara居民可以通过在此在线申请获取营业税证书。

圣何塞

圣何塞居民可以邮寄或亲自提交申请表以申领营业税登记证。

- 邮寄地址:

- San Jose市 - 财务部,收件人:付款处理

- 亲自送达的地址:

- City of San Jose,客户服务窗口一或二

徽章和标牌要求

Lyft 徽章

Lyft徽章是Lyft的官方商业外观。它帮助乘客和执法人员识别您的车辆。

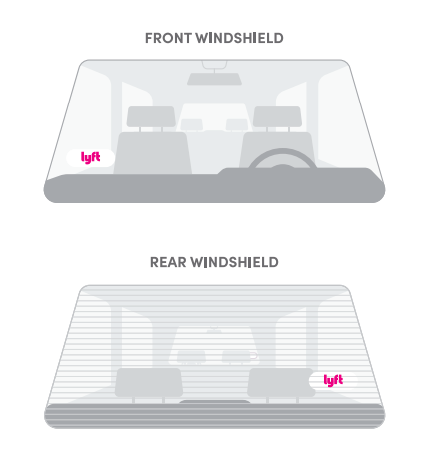

加利福尼亚州公共事业委员会(CPUC)规定,加州的司机在司机模式下必须始终显示两个Lyft标志——一个在前挡风玻璃上,另一个在后挡风玻璃上。

每次进入司机模式时,Lyft徽章应显示在挡风玻璃乘客侧的下角。确保在不处于司机模式时移除徽章。

机场标牌

在 OAK、LAX 或 SFO 提供打车服务时,您还须在前挡风玻璃上贴示机场许可证。

加利福尼亚州司机规定

在加利福尼亚州提供行程服务时,请务必遵守这些规定,并在您的电子邮件中查看来自 Lyft 的重要更新。

司机模式时间限制

除了Lyft的强制休息和时间限制,加州司机不得:

- 在24小时内连续开车超过10小时而不休息8小时。

- 在 15 小时内连续驾驶超过 10 小时而不休息至少 8 小时。

最佳实践

了解您的保险

加利福尼亚州颁布了州法案 AB 2293,自 2015 年 7 月 1 日起生效。根据此项法律,包括 Lyft 在内的运输网络公司必须提供第三方责任主险,并在阶段 1 期间提供 $200,000 的超额责任险。

Lyft的第三方汽车责任保险将在时间段1成为您的主要保险。Lyft还将在时间段1维持$200,000的超额责任保险。

第1段

时间段1从你登录司机模式开始,到你接受行程叫车时结束。

一旦您接受乘车请求,即开始进入阶段 2。一旦您接载乘客,即开始进入阶段 3。阶段 3 在您结束行程时立即结束。然后,您会返回到阶段 1,直到接受其他乘车请求或退出司机模式。

根据 AB 2293,除非您购买共享出行保险,否则您的个人汽车保险单,包括您购买的任何可选保险(如综合险和碰撞险),将不会覆盖您在加利福尼亚州提供共享出行服务期间。

部分保险公司提供专为共享出行司机设计的保险产品。这些保单不仅可以覆盖您的个人驾驶,还包括共享出行驾驶,并提供额外的保障。

我们尽量在新的保险产品适用于共享出行司机时及时通知司机。联系您的保险公司、代理人或经纪人以了解更多。点击这里了解更多信息。

- 查看责任保险证明书(加利福尼亚州)

搬迁到或离开加利福尼亚

如果你在其他州已经是司机,并且你要搬到加利福尼亚,请向我们发送以下信息:

- 您的迁居日期

- 您的新收货地址

- 清晰的照片:

- 加利福尼亚州驾照

- 您车辆的加利福尼亚州车牌

- 在加利福尼亚州签发的个人车辆保险,保单上列出您的姓名

- 加利福尼亚州车辆检查 由有执照的机构进行

如果你已经在Lyft存档了上述加州文件,你不需要再次发送它们。

现役军人申请者及其家属可以持有州外的驾照和车辆文件。选择下方的“联系支持”以验证您或您配偶的现役军人身份。

从加州搬到其他州?在这里选择你的新司机中心地点,查看你需要采取的步骤。