California Driver Information

This page provides information about vehicle, driver, and document requirements, state regulations, insurance coverage, and city-specific requirements, needed to drive with Lyft in the state of California.

To apply to drive in California, submit an application online or in the Lyft Driver app –– download it from the App Store (iOS) or the Google Play store.

Drivers in California may be eligible for a healthcare subsidy. Drivers in California aren't required to accept any specific request for services as a condition of maintaining access to the Lyft app or Lyft platform.

Skip to:

What you need to drive with Lyft in California

Drivers are required to maintain current documents. Failing to update a required document before the expiration date results in temporary deactivation.

Use your Lyft Driver app to upload your documents. To add documents in the app, tap 'Account' in the main menu, then 'Documents.

Vehicle requirements

All vehicles must meet the following criteria:

- 2013 or newer

- 4 doors

- 5-8 seats, including the driver's

- Not a taxi, stretch limousine, or non-Express Drive rental vehicle

- Not titled as salvage, non-repairable, rebuilt or any other equivalent classification

- California license plate*

*Drivers may upload a temporary license plate while waiting for a permanent plate number. Once you add a vehicle to your profile, you have 60 days to upload a permanent plate number.

Active duty military applicants and their dependents can have an out-of-state license plate.

See if your vehicle qualifies for premium ride types to earn more on each ride.

In select cities, you can rent a car through Express Drive with standard insurance included. Rental vehicles must be rented through the Express Drive program to be approved for use on the Lyft platform. Learn more about Express Drive.

Driver requirements

- Valid California driver’s license

- California temporary licenses are acceptable

- Active duty military applicants and their dependents can have an out-of-state driver's license and vehicle documents. Select 'Contact support' below to verify your or your spouse's active military duty status.

- 25 years or older

- Complete a driver screening, which includes a driving history check and criminal background check. Learn more about driver screenings.

- Please be aware that California law, including Cal. Pub. Util. Code § 5445.2 and Cal. Bus. & Prof. Code § 7458, requires Lyft to disqualify applicants with certain criminal history from driving on the Lyft platform.

- Have a smartphone that can download and run the Lyft Driver app. Learn more about phone software recommendations.

Document requirements

- Driver profile photo: Learn how to take the best photo

- Personal vehicle insurance issued in California with your name listed on the policy

California vehicle inspection

Drivers are required to have a vehicle inspection completed by a licensed mechanic before being approved to drive. Once completed, upload your inspection form to your Lyft Driver app or Dashboard.

You can easily find an inspection location in your driver app. Don't forget to bring a copy of this form to your appointment.

You can also complete your inspection at a third-party site. Inspections normally cost around $20-$30, depending on the facility. Lyft does not cover the cost of inspections done by third-party sites.

Inspections must be completed every 12 months or 50,000 miles, whichever occurs first. The 50,000-mile requirement includes miles driven when not logged onto Lyft's Platform. If you log over 50,000 miles before your annual renewal date, you must get a new inspection.

Los Angeles, San Diego, San Francisco, San Jose, and San Mateo vehicle inspection

Drivers are required to pass a vehicle inspection before being approved to drive. This inspection must be completed by a licensed mechanic:

- You can find an inspection location and schedule an appointment in your Lyft Driver app.

- Print this form and bring it to your appointment.

- Once completed, upload your inspection form to your Lyft Driver app.

To upload your inspection form:

- Open the menu in your Lyft Driver app.

- Tap 'Account.'

- Tap 'Documents.'

Lyft doesn't cover the cost of inspections.

Inspections must be completed every 12 months or 50,000 miles, whichever occurs first. The 50,000-mile requirement includes miles driven when not logged onto Lyft's Platform. If you log over 50,000 miles before your annual renewal date, you must get a new inspection.

Business license

If you drove with Lyft for more than 30 days in the last fiscal year, the city or county where you live may require you to obtain a business license.

Keep your business license in your vehicle in case the authorities ask to see it.

If the city or county where you live doesn't require a business license, you don’t need to get a business license anywhere else to drive with Lyft but there may be additional requirements. Refer to your local city or county's website for these requirements.

Select your city for details:

Fresno

Fresno residents can obtain a Business Tax Certificate by applying online here.

Grover Beach

Grover Beach residents can obtain a Business Tax Certificate by visiting the Community Development Department. Application instructions can be found here.

Los Angeles

Los Angeles County residents may need to register their business with the Office of Finance of the City of Los Angeles and obtain and hold a Tax Registration Certificate. View rules for registration.

If you’re unsure whether the business tax rule applies to you, contact the City of Los Angeles Office of Finance.

Go to the Notice of Fair Chance Ordinance.

Orange County

Orange County residents can find information about local business license requirements by selecting their city on Orange County's permit page.

Sacramento County

Unincorporated Sacramento County residents can obtain a general business license on Sacramento County's official page.

San Diego

Residents of incorporated cities within San Diego County are required to obtain a business license (Business Tax Certificate).

Business licenses aren't required for residents of unincorporated cities within San Diego County. To apply for a Business Tax Certificate, follow these instructions from San Diego County.

San Francisco

San Francisco residents who drove more than 30 days in the last fiscal year are required to have a business license, officially named a Business Registration Certificate.

Visit this page to register as a business in San Francisco. Select ‘Continue’ to start your application.

You’ll be asked to provide the following information:

- Your business: Most drivers choose Sole Proprietorship as their Organization Type and use their legal name as their Business Name. You’ll also need to add your Business Tax ID and Start Date of Business in San Francisco.

- Ownership information: You’ll be asked to fill out your personal information

- Contact information: Your contact information may be the same as your ownership information from step 2. All tax information will be sent to the person and address you enter here.

- Location information:

- Location Trade Name: Most drivers use their Business Name from step 2, but this can be any other name used for your business

- Start Date in SF: The date business activity started at this San Francisco location

- Tax and Fees: Most drivers select “No” for each tax and fee. Review this page to confirm which taxes and fees apply to you.

- Business Activities: Most drivers register as a Transportation Network Company Driver (17B). See more information about business activities codes.

- Registration:

- Estimated SF Payroll Expense: The approximate amount of San Francisco payroll costs you expect during the current calendar year

- Estimated SF Gross Receipts: Doesn’t need to be an exact amount. If you drive in multiple counties, do your best to estimate San Francisco fares based on how often you’re in the city. See more information about gross receipts.

Once you've entered this information, you’ll receive an email to complete the business license application process.

Important notes:

- Once you register for a Business Registration Certificate, the City adds the business name, address, and certain other details to the SF OpenData website. This means that other than your SSN, any data you share, including your address, will be public. This information may also be shared with San Francisco City and County tax-collecting entities.

- After registering, the City may say you owe extra fees and late charges for driving in previous years. Don’t pay the registration fee until you get a specific email from the Treasurer and Tax Collector removing the penalties and interest from your account balance.

Keep in mind the information above isn’t business or tax advice. For specific questions about applying for a business license or associated fees, see San Francisco's New Business Registration Instructions or contact the Office of the Treasurer & Tax Collector.

Santa Barbara

Santa Barbara residents can obtain a Business Tax Certificate by applying online here.

San Jose

San Jose residents can obtain a business tax certificate by submitting an application form by mail or in-person.

- Address if sending by mail:

- City of San Jose - Finance Department, Attention: Payment Processing

- Address if delivering in person:

- City of San Jose, Customer Service Window 1 or 2

Emblem & placard requirements

Lyft Emblem

The Lyft emblem is Lyft’s official trade dress. It helps passengers and law enforcement identify your vehicle.

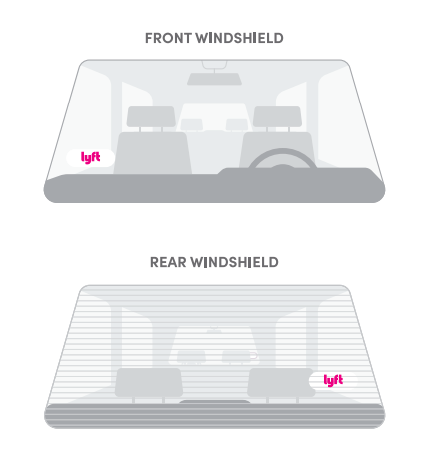

The California Public Utilities Commission (CPUC) requires drivers in California to always display two Lyft emblems when in driver mode — one on the front windshield and the other on the rear windshield.

If you’ve just been approved to drive, you should receive your Lyft emblem within 1-2 weeks. If you didn't get one or need a new one, order one in your Lyft Driver app or Dashboard. While waiting for it to arrive, you may print a temporary emblem.

The Lyft emblem should be displayed in the lower corner of your windshields on the passenger side every time you enter driver mode. Make sure to remove the emblem when you are not in driver mode.

Airport placards

When giving rides at OAK, LAX, or SFO, you’re required to display an additional airport placard in your front windshield.

California driver regulations

Be sure to follow these rules when giving rides in California, and look for important updates from Lyft in your email.

Hourly driver mode limits

In addition to Lyft's mandatory break and time limits, California drivers may not:

- Give rides for more than 10 consecutive hours in a 24-hour window without taking an 8 hour break.

- Give rides for more than 10 total hours in a 15-hour window without taking at least an 8 hour break.

Best practices

- Display all required emblems and placards

- Always have your driver’s license and insurance document

- Follow all airport rules

- Don't accept street hails

- Don't accept cash for rides

- Don't wait in taxi lines

Know your insurance

Effective July 1, 2015, California enacted State Bill AB 2293. Under this law, Transportation Network Companies, including Lyft, are required to provide primary third-party liability insurance and maintain $200,000 of excess liability coverage during Period 1.

Lyft’s third-party automobile liability coverage will be your primary coverage during Period 1. Lyft will also maintain $200,000 of excess liability coverage during Period 1.

Period 1

Period 1 begins when you log in to driver mode and ends when you accept a ride request.

Once you accept a ride, Period 2 begins. Once you pick up a passenger, Period 3 starts. Period 3 ends as soon as you end the ride. Then, you’re back in Period 1 until you accept another ride request or log out of driver mode.

Under AB 2293, your personal automobile insurance policy, including any optional coverages you’ve purchased such as comprehensive and collision, won’t cover your rideshare driving in California unless you’ve also purchased rideshare coverage.

Some insurers offer insurance products designed specifically for rideshare drivers. These policies can cover both your personal and rideshare driving, and offer additional coverages.

We try to keep drivers informed as new insurance products become available for rideshare drivers. Contact your insurance company, agent, or broker to learn more. Find out more here.

- View Certificates of Liability Insurance for California

Moving to or from California

If you're already a driver in a different state, and you're moving to California, send us a message with the following info:

- The date you're moving

- Your new shipping address

- Clear photos of your:

- California driver’s license

- California license plate for your vehicle

- Personal vehicle insurance issued in California with your name listed on the policy

- California vehicle inspection from a licensed facility

If you already have the California documents listed above on file with Lyft, you don't need to send them in again.

Active duty military applicants and their dependents can have an out-of-state driver's license and vehicle documents. Select 'Contact support' below to verify your or your spouse's active military duty status.

Moving from California to a different state? Select your new location here to see what steps you’ll need to take.